Why Blockchain Matters

Recognizing Disruptive Technology

How Kodak invented the camera that would destroy it

One of the most famous case studies teaching lack of foresight when it comes to disruptive technologies involves the infamous demise of the camera and film company Kodak.

Despite the fact that the first digital camera was invented in Kodak’s own R&D department by Steve Sasson in 1975, and when the first consumer product hit the market in 1981, Kodak’s own Head of Market Intelligence handed in a fairly accurate report predicting the adoption-rate of digital cameras, Kodak’s management failed to see digital cameras as disruptive technology for two decades ending up with the company filing for bankruptcy in 2012.

How Nokia lacked initiative to participate in the Smartphone battles

Nokia, a Finnish company which started out in the pulp mill industry back in 1865, in 1960 Nokia first ventured into the telecommunication markets going from military, government and enterprise markets slowly towards consumer markets with car-phones and personal computers, until 1987 when they rolled out the first product that can truly be described as a mobile phone, the Mobira Cityman 900.

While we won’t go into the inner workings of Nokia’s corporate culture & structure, we will establish that it is that same culture which was the main reason for their failure in adopting the innovation of smartphones. The smartphone innovation was foreseen by Nokia’s Management as early as 2005, and it was also viewed as an important shift in the market. The problem arose when the top and middle management had to do something at risk of losing their status due to shifting organizational structures.

So it wasn’t any lack of foresight as in Kodak’s case. It was lack of initiative and fear of internal struggles that brought Nokia to let innovation pass it by.

Nokia’s fall from grace teaches us that knowledge isn’t enough, you gotta have the guts to do something about it.

Conclusion

Lack of foresight to recognize disruptive technologies and lack of initiative to move with innovation and not against it can lead even the largest entities to financial decay. While similar cases such as Blockbuster vs. Netflix, exist and will continue to exist. The case of the Blockchain vs. Bank or Crypto vs. FIAT is not the same. Faithfully a wide range of financial institutions have recognized the disruptive technology that is the blockchain and began to develop and adopt it, even partially. So there are no worries about the blockchain bankrupting the entire banking system.

History of the Blockchain

The foundations of the blockchain have been conceptualized as early as 1990 and refined by Haber and associates up until 1992.

It wasn’t until 2008 when the subject suddenly re-surfaced by an anonymous alias only known as Satoshi Nakamoto who soon after, released the first version of Bitcoin on SourceForge in 2009

The rest, as they say, is history. One of rapid growth in both capital, sustainability, use cases and number of players.

You can learn more of the fork-history of cryptocurrencies visually on Map of Coins

Benefits of Blockchain

By solving the double-spending problem in an effective and autonomous manner and not requiring intermediaries to validate the transfer of assets or currency, the blockchain has given us the potential to significantly lower the costs of transactions of all kinds - logistic, financial, legal and more. with game-changing consequences to costs of transferring goods, services, assets, and currency across the globe.

The blockchain also offers the possibility of contracts that are autonomously enforceable called Smart Contracts, these contracts manage the transfer of funds and the conditions of ownership without requiring intermediaries such as courts of law.

Using the IPFS protocol on top of a blockchain solves the short life-span of online web pages enabling the longevity if information through a method of storing & sharing rich media websites. In other words, this gives the potential for a decentralized and uncensorable web including file sharing.

Market Adoption of Blockchain Technologies.

Blockchain’s popularity is on the rise, from consumer-facing money-management and trading solutions, to enterprise compliance & regulation solutions, ready to use blockchain infastructures and even attempting to solve the major ownership problem of DNA samples, Great, but how much money does this a niche startup industry actually bring?

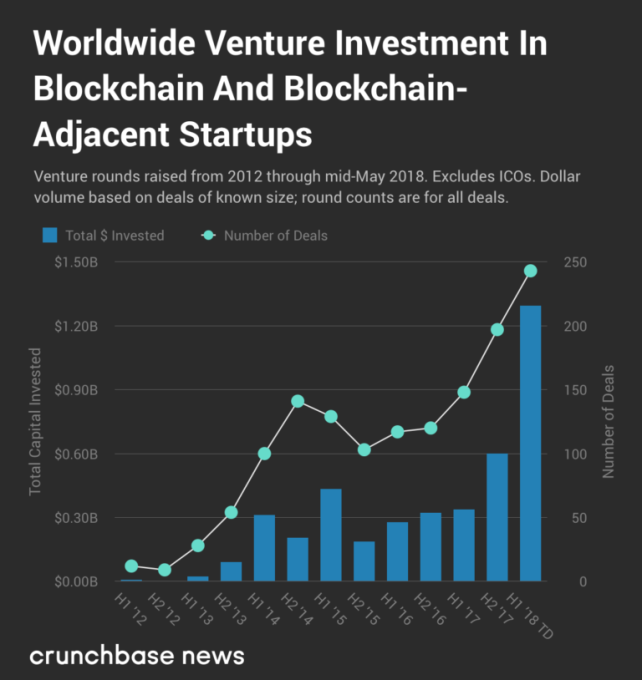

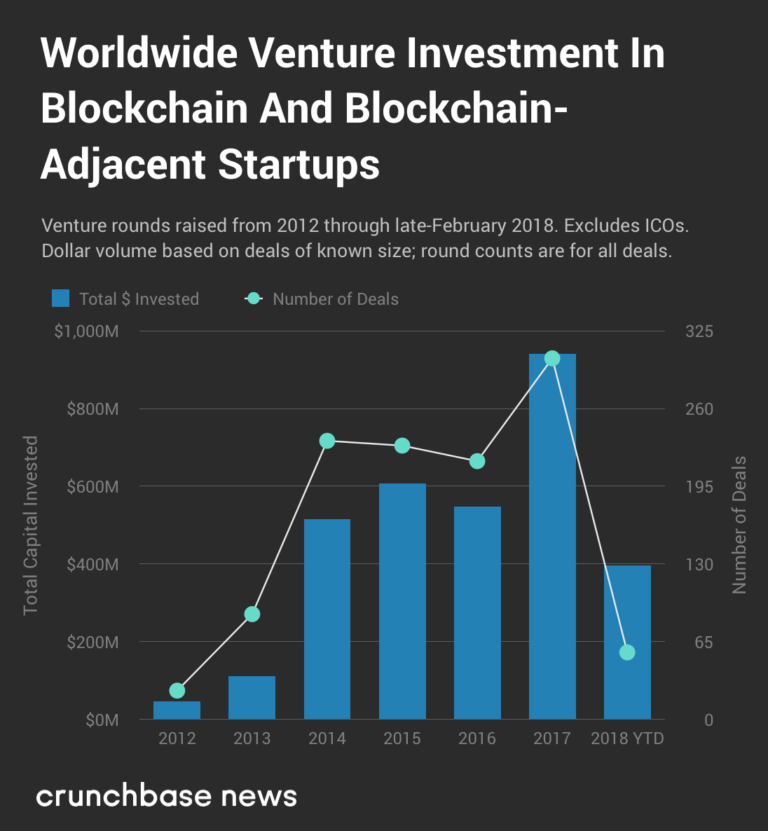

Well, so far the blockchain startups have gained a rapid growth in VC funds headed its way, expanding at a median rate of 150% per year since 2012 when it collected 25,000 dollars in VC funding, to 2018 when it collected $1.3B, so far.

Putting startup projects aside, large enterprise corporations are far from being left out in the dust. JP Morgan is working on numerous projects along with Quorom which it launched earlier this year.

IBM, Oracle, SAP, Microsoft, and Amazon have all launched several blockchain solutions covering a range of market verticals and use cases.

Read more on blockchain adoption rate at Forbes.

When thinking of the possibilities of this solution outside the standard use-case of a private currency, this solution to the double-spending problem solves major issues in business, such as logistics management, contract management, copyright management; as well as government such as identity management, asset management, government budget management, public transport and more. all of these have their own set of use cases, for example, identity management can be used for cross-service identity management and individual identification and even allow for online voting, with minimal concerns to identity theft.

Let’s take a look at some of the ways the blockchain is being utilized today and might be utilized in the coming future

Case Studies & Use Cases

In what may well be a state-wide embarrassment Russia should soon launch it’s CryptoRuble come 2019 on its own governmental blockchain infrastructure.

For good and bad the Chinese is making headway with blockchain technology with ICBC patenting its own blockchain platform and the Chinese government is piloting it’s Social Credit and Govenrnance system aimed to launch by 2020 with blockchain expected to be the underlying technology. Read More in the original research paper by Dr. Rogier Creemers.

South Africa’s Central Bank had a succesful experiment with blockchain technology

The UK has recently published a white paper hinting towards adopting a blockchain solution for border customs and tariff control. Read More on TechCrunch

UBS, an American investment banking company, has been an early riser to the disruptive FinTech, and had begun developing blockchain solutions as early as 2015. We highly recommend reviewing their whitepaper on how to utilize blockchain technology as a trust and regulatory mean.

The government of Malta, which is hyper-aware of blockchains potential, has started collaborating with Omnitude to create the first governmental public transport system backed by blockchain technology. On top of being the first to enact the first laws regulating blockchain technology and cryptocurrency transactions.

Supply chain management (SCM) software is being used by medium and large enterprises for cataloging the transfer of goods from the point-of-manufacturing to point-of-sell, this is a major market vertical worth $12.2B with rapid yearly growth (~12.7% in 2017). all major retail and wholesale providers use such solutions and may soon transfer to a more efficient blockchain based solution such as provenance, skuchain, Blockverify and most notably SAP.

Ride-Sharing has gained a lot of traction in recent years, and already it might be facing disruption with blockchain technology.

DiDi might not have been the first, but by dominating the Chinese market has become the biggest ride-sharing app valuated at $55B. They have recently put out a press release that they’ll be integrating blockchain technology as part of their product

Other companies such as DASCEE or ArcadeCity are also attempting

Read More on how blockchain can benefit the ride-sharing industry.

Online voting is another one of the problems blockchain aims to solve with services such as Agora or Voatz who’ve already piloted their solution in West Virginia’s state election.

More robust solutions aim to fix the democratic process itself through digital means. Projects such as Liquid Democracy target domestic (US) as well as foreign government bodies to use their new model for a liquid democracy.

In the healthcare industry the blockchain is helping candidates take control of their samples’ proprietary value through the blockchain, with other applications already seen on the horizon.

Cloud storage is maintained today with central servers spread across the world giving that give rise to problems such as end-user proximity to the servers, costs of establishing data centers and more. Projects such as STORJ aim to solve these problems using the blockchain.

Read More on Forbes.

Solving the problems of copyright records and management has been a huge hurdle for artists and government alike. Using Smart Contracts as well as retaining ownership of a media file to the original artist using blockchain aims to abolish this problem.

Read More in Alexander Savelyev’s study.